Quantconnect Trending System

Quantconnect is World’s Leading Algorithmic Trading Platform It provides a free algorithm backtesting tool and financial data so engineers can design algorithmic trading strategies.

The following is a simple Trending System. It is for demo purpose only.

The model uses Bollinger Bands(BB) and Relative Strength Index(RSI)

Version 1 uses 4-hour aggregates. It is a Mean reverting strategy where it assumes SPY will revert to its historical mean.

BB uses past 30 data points and 2 standard deviation for bands RSI uses past 14 data points

The model sells when RSI > 70 AND Price > BB Upper Band

The model buys when RSI < 30 AND Price < BB Lower Band

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

#original

class Algo101_Version_1(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2020, 1, 1) # Set Start Date

self.SetEndDate(2020,10,1) #Comment

self.SetCash(100000) # Set Strategy Cash

symbol = "SPY"

self.ticker = self.AddEquity(symbol,Resolution.Hour).Symbol

self.rsi = self.RSI(symbol, 14, MovingAverageType.Simple,Resolution.Hour)

self.bb = self.BB(symbol,30, 2, MovingAverageType.Simple,Resolution.Hour)

self.RegisterIndicator(symbol, self.rsi, timedelta(hours = 4))

self.RegisterIndicator(symbol, self.bb, timedelta(hours = 4))

self.SetWarmup(timedelta(30))

def OnData(self, data):

symbol = "SPY"

if data[self.ticker] is None: return

if (not self.rsi.IsReady) or (not self.bb.IsReady): return

value = data[self.ticker].Value

buy_signal = self.rsi.Current.Value < 30 and value < self.bb.LowerBand.Current.Value

sell_signal = self.rsi.Current.Value > 70 and value > self.bb.UpperBand.Current.Value

if buy_signal: self.SetHoldings(symbol,1)

if sell_signal: self.SetHoldings(symbol,-1)

if self.Portfolio.Invested:

if self.Portfolio[symbol].IsLong and not buy_signal:

self.Liquidate(symbol)

if self.Portfolio[symbol].IsShort and not sell_signal:

self.Liquidate(symbol)

The model 1 performs badly.

The idea is to change Mean Reversion Strategy to Momentum Strategy by switching sell and buy signal and modify the RSI period and BollingerBands’ period and standard deviation.

Version 2 uses 4-hour aggregates. It is a momentum strategy where it assumes the price will maintain its momentum for a while

BB uses past 20 data points and 1.5 standard deviation for bands RSI uses past 10 data points

The model buys when RSI < 40 AND Price < BB Upper Band

The model sells when RSI > 60 AND Price > BB Lower Band

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

#original

class Algo101_Version_2(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2020, 1, 1) # Set Start Date

self.SetEndDate(2020,10,1) #Comment

self.SetCash(100000) # Set Strategy Cash

symbol = "SPY"

self.ticker = self.AddEquity(symbol,Resolution.Hour).Symbol

self.rsi = self.RSI(symbol, 10, MovingAverageType.Simple,Resolution.Hour)

self.bb = self.BB(symbol,20, 1.5, MovingAverageType.Simple,Resolution.Hour)

self.RegisterIndicator(symbol, self.rsi, timedelta(hours = 4))

self.RegisterIndicator(symbol, self.bb, timedelta(hours = 4))

self.SetWarmup(timedelta(30))

def OnData(self, data):

symbol = "SPY"

if data[self.ticker] is None: return

if (not self.rsi.IsReady) or (not self.bb.IsReady): return

value = data[self.ticker].Value

sell_signal = self.rsi.Current.Value < 40 and value < self.bb.LowerBand.Current.Value

buy_signal = self.rsi.Current.Value > 60 and value > self.bb.UpperBand.Current.Value

if buy_signal: self.SetHoldings(symbol,1)

if sell_signal: self.SetHoldings(symbol,-1)

if self.Portfolio.Invested:

if self.Portfolio[symbol].IsLong and not buy_signal:

self.Liquidate(symbol)

if self.Portfolio[symbol].IsShort and not sell_signal:

self.Liquidate(symbol)

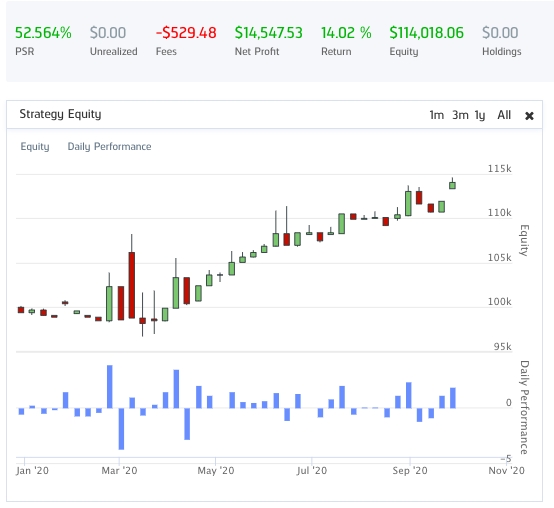

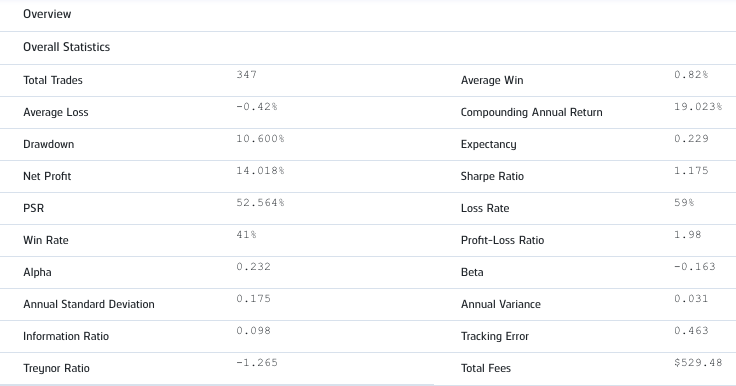

Model 2 has a better return after modification.